Have you ever heard of the Bitcoin 210,000 block theory to increase the value of your Bitcoin holdings? Two hundred and ten thousand isn’t just an arbitrary figure—proven science corresponds to that number. This article demonstrates why you should think about the 210,000 block theory and how you can verify your BTC transactions on-chain.

If you have been in the crypto and blockchain space for a while, you may have heard this theory: You should HODL Bitcoin for at least 210,000 blocks. What does HODL mean? HODL is an acronym for “Hold On for Dear Life,” referring to holding cryptocurrency regardless of price volatility. HODL originated years ago from a typo in an old Bitcoin forum where one user said he was holding bitcoin.

Hold on for Dear Life – 210,000 blocks later

According to the HODL theory, bitcoin held for at least 210,000 blocks after being sent will appreciate. As of September 26th, 2022, there are no transactions with a lower fiat valuation compared to 210,000 blocks in the future.

- For example: If someone received a bitcoin payment in Block 500,000, it should be held until block 710,000 to determine price appreciation compared to block 500,000.

Every bitcoin (or satoshi) ever mined or transacted has a higher fiat valuation after 210,000 blocks have elapsed.

The block reward “halving” event is understood

Bitcoin has value because it has a supply cap of 21 million, and it can’t be duplicated, creating scarcity. The block reward halving that occurs every 210,000 blocks, roughly every four years, restricts the supply of bitcoin even further. Every 210,000 blocks, the number of newly mined bitcoins halves reducing the supply. Bitcoin’s supply mechanism is hard coded into the network and controlled through maths-based inflation.

Bitcoiners refer to saving as HODLing, a nod to the word’s origin from the Bitcoin forum. This inflation keeps the price of bitcoin rising and incentivizes saving based on this theory.

A test of the theory is required

We did a basic test of this theory, and the results were terrific. We tested all transactions using Bitcoin price data dating back to July 18th, 2010. The code is accessible here. Every bitcoin transaction ever sent has a higher fiat value after 210,000 blocks have passed. The theory explains why—every single transaction has a higher value.

There are two methods to test this theory using traditional finance terminology. In this case, we will provide a more detailed explanation.

A priori simulation

You cannot backtest for any transactions mined in the first 210,000 blocks, as there were no blocks that existed 210,000 blocks before. For transactions, not 210,000 blocks old, you can only look backward and see the fiat price of bitcoin.

Suppose you just sent one bitcoin last week. It would be a few years before that transaction was 210,000 blocks old. To test this theory for such a transaction, you would have to go 210,000 blocks backward (210,000 blocks backward) and see how much one bitcoin was worth then. After look how well you would have done if you had sent the same transaction 210,000 blocks ago.

What if a transaction is already 210,000 blocks old? Then the code tested its 210,000 blocks forward performance.

Performance testing forward

Take any transaction and add 210,000 to the block number to see the current price if the transaction were to be processed now. Time must pass (approximately four years) for a transaction to be 210,000 blocks old before you can test whether this theory stands the test of time.

For example, A glance at the valuation of bitcoin in block 560,000 would tell you whether you received a transaction in block 350,000.

In Block 350,000, one bitcoin has a value of ~$247.

Whereas one bitcoin in block 560,000 has a value of ~$3,581. That’s a 14.5x return on investment!

It’s essential to test both ways

With certain transactions, you can examine the difference between fiat values in both directions to see the 210,000 block hold theory in action more than once with the same Transaction ID (TxID).

For example, in both directions, you can look at blocks 130,000 and 560,000 to see the fiat value of a transaction from block 350,000.

Both will provide proof of this theory as one bitcoin for block 130,000 is worth ~$31.

You can test the theory yourself

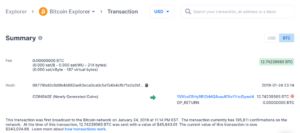

When you verify any blockchain transaction for yourself, you can see how beautiful it is that the technology is entirely public and transparent.

You can choose any TxID you like, but we recommend finding one on your own. It’s more enjoyable when you see how much money you would have made if you invested in bitcoin sooner. Seeing how much you’ve gained is even more exciting.

Look up the block that the TxID is from on blockchain.com’s block explorer. Add or subtract 210,000 from that block number, depending on the block. Blockchain.com’s block explorer allows you to see both the current and past fiat values for each transaction sent.

Make sure that a fiat valuation appears in the green box. The value depicts the amount of Bitcoin sent in that transaction. To toggle between Bitcoin and USD (or other fiat currency), click the toggle switch in the upper right.

Hovering your mouse pointer over this same box and clicking will switch between the fiat value of that bitcoin and the USD value at the transaction time. Divide the current valuation by the valuation sent to determine the percentage gain.

For example, one bitcoin today is worth $5,000 and $500 210,000 blocks ago, for a 1,000% gain. Not too shabby for some magical internet cash.

TL;DR version

Whether you’re a newbie to bitcoin or a veteran who has been in the space for years, we encourage you to look up some transactions on the blockchain and compare fiat valuations with a 210,000 block difference. We are confident that you will be pleasantly surprised by the numbers.

We haven’t found a lower fiat value after 210,000 blocks. You might want to save some bitcoin for at least 210,000 blocks and see what happens.

Follow my Twitter @JoyyuanWeb3 to learn about the trends of Blockchain, Crypto, and Web3!